Learn affordable gold investment

Get our Beginner’s Guide

Get discounts on Gold and Silver

Why Invest in Gold?

Protect your savings from

Inflation

You lose 2% p.a. in purchasing power when you save in cash because of inflation.

Why lose money unnecessarily?

Protect yourself against Currency Devaluation

Everyday a new currency is falling. Argentina, Lebanon, Turkey, Sri Lanka, Venezuela… even the Japanese Yen and the Euro!

How are your protecting against Currency Devaluation?

Protect yourself against Banking Crisis

Physical Gold is the only asset which is not someone else’s liability and has no counterparty risk.

Protect yourself against Market Crash

As little as 5 – 15% of your wealth in gold can protect the rest of your wealth. Insurance has to be renewed every year, gold lasts until sold.

Gold is a smarter way to protect your wealth

Gold is the Ultimate Safe Haven Asset

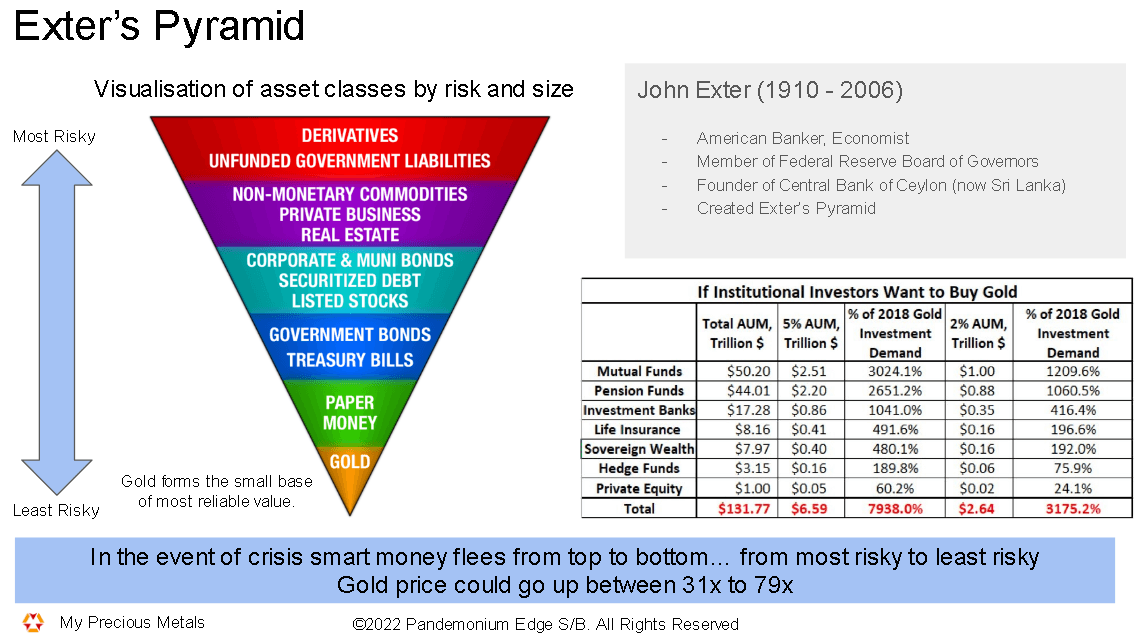

John Exter was a central banker and economist. He developed Exter’s Pyramid as a tool to visualise asset classes by risk and size, and to show the flight to quality from most risky to least risky in the event of a crisis. The pyramid demonstrates the importance of gold: gold is the quintessential safe haven asset that is no one’s liability and has zero counterparty risk.

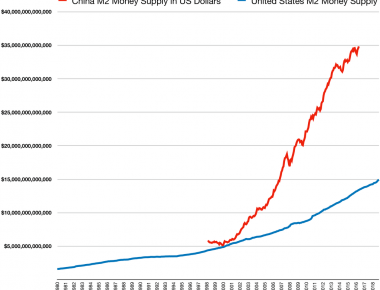

Global Debt is at Danger Levels

Global debt levels have exploded to $226 trillion, or more than 256% of GDP. The World Bank defines 77% as the “tipping point beyond which sovereign debt turns bad”. In 2020, global debt experienced the largest surge in 50 years and approached debt levels not seen since World War 2. The last time debt levels were that high, there were multiple financial crises globally.

The IMF warns that “the debt surge amplifies vulnerabilities, especially as financial conditions tighten”.

A Debt Crisis can wipe out your life savings

Many countries have had debt crises which wiped out their currencies. These countries include Sri Lanka, Lebanon, Argentina, Venezuela and Zimbabwe. According to the World Bank there have been at least 20 countries have experienced some form of debt distress in the last decade. Even without a debt crisis, there are other countries whose currencies have devalued over 70% in the last 30 years such as India and Vietnam.

Central Bank response to every crisis is to print more money... Which drives inflation and devalues your savings (Milton Friedman)

Milton Friedman explains causes of inflation

Top Investment Advisors and Private Bankers recommend Gold

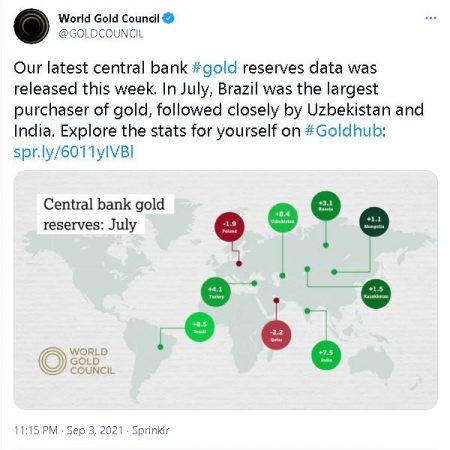

Central Banks are the largest buyers and hoarders of gold...

Global superpowers hold 60-80% of their FX reserves in gold. Because gold has NO counterparty risk and will be REVALUED UP in the event of a global debt crisis

What Our Readers Say

“I like it because it writes about a topic which nobody often writes about to retail investors”

Partner at Law Firm

“Independent advice, research and curated articles / announcements. Looking forward to more additions.”

Proprietor at Own Business

“Deeply researched information and the initiative to educate public about precious metals”

Producer at Digital Business

Who are we

- We are risk management consultants with over 20 years experience in building backup plans

- Our clients have included banks, insurance companies, asset managers and pension funds

- Our mission is to help you make a backup plan for your wealth

- In the event that banks fail, monetary systems fail, and/or governments fail

- If you are an institution or Ultra-High Net Worth Individual (UHNWI) and need more personalized service, then please contact us directly

- We are not bullion dealers but we have contacts with bullion dealers and precious metals fund managers to assist you